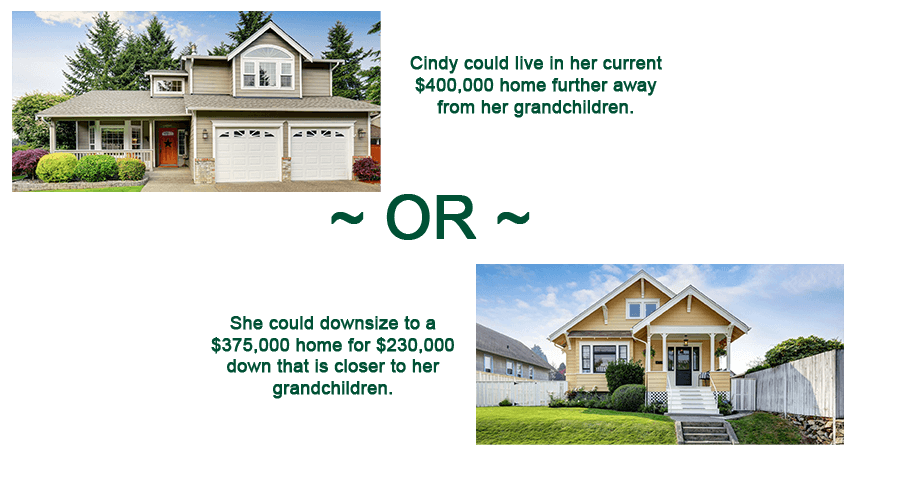

If you are 62 or older, you may be thinking about buying a new home that better meets your needs in retirement. Maybe you have your sights set on a home that’s closer to your children, or one that will better accommodate your needs as you age, or one that is breathtakingly beautiful and near the ocean.

You may also be thinking that you cannot afford to buy such a home, or that you don’t want to drain your nest egg to be able to afford it. Before you decide, consider the flexible financing option called a HECM for Purchase loan—which offers some distinct advantages over a traditional mortgage or paying all cash.

We’ll help you clearly see differences between loan programs, allowing you to choose the right one for you, whether you’re a first-time homebuyer or a repeat buyer.

What is a HECM for Purchase (H4P)?

A Home Equity Conversion Mortgage—also known as a reverse mortgage—for Purchase (H4P) is a Federal Housing Administration (FHA)-insured home loan that is designed to help homebuyers age 62+ to buy a new home that better meets their current lifestyle.